Description

Reviews

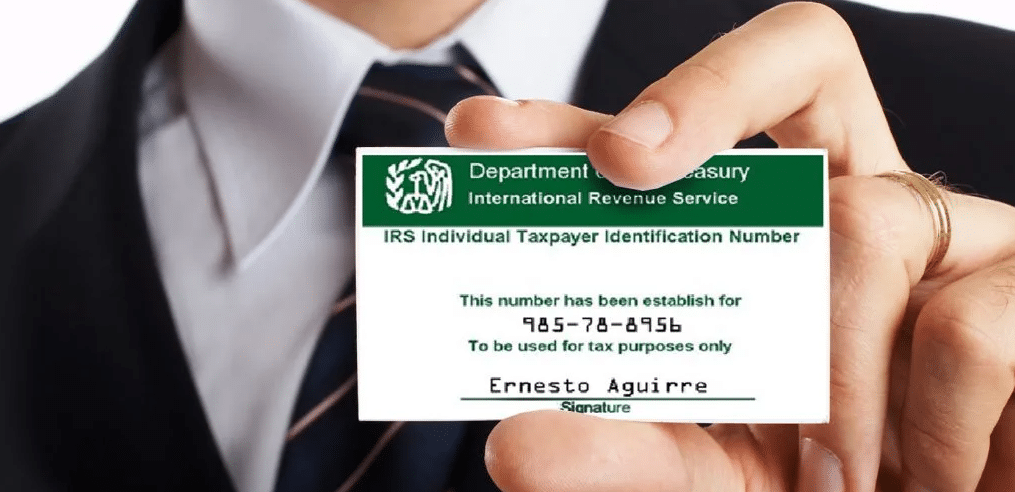

WHAT IS AN ITIN?

An Individual Taxpayer Identification Number (ITIN) is a United States tax processing number issued by the Internal Revenue Service for those who need to file a federal tax return but aren’t eligible for a Social Security number.

Why do I need an ITIN?

- filing a US tax return

- claiming a tax refund

- expecting to receive taxable Scholarship, Fellowship or Grant Income and you are not eligible for a Social Security Number

- claiming a tax treaty benefit

- open a bank account or apply mortgage

CERTIFIED AGENTS

Certified Acceptance Agents can verify your supporting documents, which means you only have to send copies to the IRS and can take the originals with you when you leave.

What do I need from you?

- You need to provide Original Document (National Identification Document)

- Foreign address

- Video Call is required.

The processing time ( 12 to 18 weeks) due to Coivd-19

{{ reviewsTotal }}{{ options.labels.singularReviewCountLabel }}

{{ reviewsTotal }}{{ options.labels.pluralReviewCountLabel }}

{{ options.labels.newReviewButton }}

{{ userData.canReview.message }}